Just when we thought the economy had bottomed out and things were starting to turn around, the news on the higher education financial front continues to be pretty dismal. As in past recessions, it's very likely that there will be a lag behind the general upswing in the economy and when higher education starts to benefit from it. And given the depth of this recession, the lag will likely be longer and more painful to endure.

Last Saturday's

New York Times reported on the dire situation at the University of California, often considered to be the shining jewel among public higher education systems (I know the California papers have covered this story more thoroughly, but I can't get home delivery of the

LA Times or

San Fran Chronicle here on the East Coast). The UC system is trying to figure out a way to make up for a $640 million reduction in its state appropriation for this year (a combined $813 million reduction combining last year's and this year's cuts), and according to the article (and an announcement by President Mark Yudof), is implementing "furloughs, deferred hiring and cuts in academic programs" to close the gap.

While personnel cuts are never easy, UC should be applauded for the way they are undertaking it. Rather than across the board furloughs, as so many institutions have done, UC is doing it in a very progressive manner, with higher-paid employees being forced to take much longer furloughs (and therefore larger pay cuts). Faculty hiring is being reduced, and admissions to some academic programs - including the doctoral program in education at Irvine (which hits uncomfortably close to home for those of us in education schools) - are being halted. Also to Yudof's credit, the budget for the president's office in Oakland has been cut by a third. This is not just a symbolic move, as the president's office at UC is substantial and has long been accused by the ten campuses as suffering from administrative bloat.

The magnitude of the $813 million reduction in state funding over the two years can best be understood when examined on a per-student basis. Spread across the system's approximately 227,000 students, this means a reduction of over $3,500 per student, a substantial amount even if one considers that some of the reductions will (hopefully) be made in areas that do not directly impact students.

One can hold out hope that California will resolve its budget crisis in a way that does not penalize UC and the other two systems in the state in a fashion that will harm the quality of the systems in the long run. But it is hard to be optimistic given the challenges the state is facing.

----------------------------------------

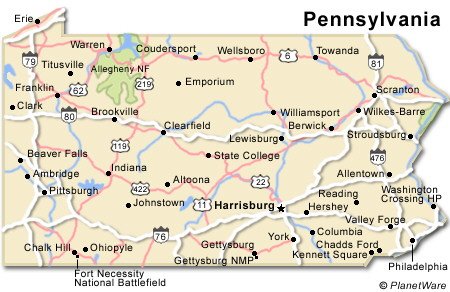

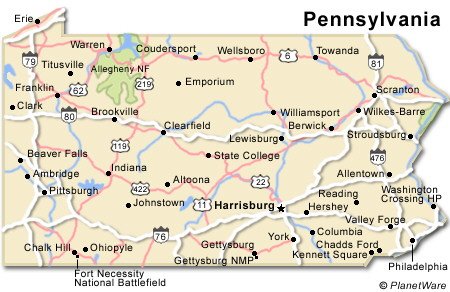

Meanwhile, back at the ranch - aka, the wild and wacky Commonwealth of Pennsylvania - as I write we are now entering out third week of the fiscal year without having a state budget. The "budget held hostage" headlines throughout the media are getting just a bit tiresome. Governor Rendell and the state legislature are locked in a budget battle that can only politely be described as a high-stakes urinating contest in trading off cuts in expenditures versus increased taxes. If it weren't so serious it would be reminiscent of the old Keystone Cops movies.

The latest budget proposed by the Governor called for a cut of $60 million in Penn State's appropriation as compared to the initial appropriation the university received last year. This includes the $20 million rescission the Governor imposed in FY 2009, combined with an additional $40 million cut for FY 2010. The $60 million represents a reduction of 18 percent of last year's intitial appropriation. To compare to the appropriation cut being absorbed by the University of California, $60 million represents a reduction of approximately $650 per student over Penn State's 93,000 students.

Evidently Governor Rendell has a penchant for starting urinating contests of late. Earlier in the year, in introducing a new state-funded financial aid initiative (interesting move, considering the dire fiscal picture the Commonwealth is facing), he excluded from participation students attending the four state-related universities (Penn State, Temple, Lincoln, and Pitt) and private colleges, all of which participate in the existing state financial aid programs. The exclusion, according to an

official in the Rendell administration was "because the state doesn't have as much control or influence over their tuition increases."

This was followed up by Rendell's request to Secretary of Education Arne Duncan to exclude the state-related universities from Pennsylvania's share of the federal stimulus funds. Rendell's initial plan to ED included the four universities, but the revised plan submitted late last month cut the $40 million that had been earmarked for them (approximately half of which would have gone to Penn State to offset the appropriation cuts) and shifted it to other public institutions. Echoing the administration's earlier statement regarding the financial aid program, this time it

said that the governor "had to make very difficult decisions about funding and has very little control over Penn State expenditures."

Penn State's response to the governor's decision was predictable. In a

letter to Secretary Duncan, Spanier wrote:

"By arbitrarily re-defining The Pennsylvania State University as non-public … the governor is setting a dangerous precedent that the Department of Education should address. If the department approves this application as it is written, it gives governors in every other state the ability to pick and choose which public institutions they may support with federal dollars."

We have yet to hear if Duncan has responded, but you can sure this is not the end of the battles over Penn State's (and the other three institutions') status as a state-related university.

Penn State's response to the Governor's proposed appropriation cut was quite pointed. President Graham Spanier threw down the gauntlet in a

letter to the Penn State "family" (which includes the Governor, as an

ex officio member of the Board) released in conjunction with last week's Board of Trustees meeting, threatening to pile the cut onto the backs of students by implementing large tuition increases. These increases would be on top of rates that place Penn State's University Park flagship campus as the most expensive (for in-state students) in the country.

At its meeitng last week, the university's board adopted two different tuition schedule. The first was based on a state budget that restored Penn State's appropriation to the initial level received last year, i.e., the level in place before the $20 million rescission by the governor. If the legislature passes and the governor signs a budget at this level (an event that most observers put as having a chance somewhere being slim and none), then the university's tuition increases will range from 3.7 to 4.5 percent (the amounts differing for resident and non-resident students at University Park, and students at other Penn State campuses). If a budget passes that includes the currently-proposed $60 million reduction from last year's appropriation, then the tuition increases will be:

- Campuses other than University Park: 4.9%

- Non-resident students at University Park: 7.9%

- Pennsylvania residents at University Park: 9.8%

The university has been clear that it will not be expecting students to pay for all of the cuts, no matter which tuition schedule is ultimately implemented. It has documented a series of expenditure cuts it has already implemented, including the decision to not give any salary increases for the 2009-2010 year. Nevertheless, the university's announcement of these potential increases says to the governor and legislature, "If you cut our budget as you are talking about, it is your constitutents - the students and their parents - who will pay the price." The need for large tuition increases may have been somewhat undermined by another Penn State

news release from the trustees meeting: "Philanthropy to Penn State sets records, despite recession."

Stay tuned for further updates.